The Great Near (& Far)

On super savers, billionaire land grabs, investing in the Delta, gentrification, and CRT...

Hey folks. This is the 19th edition of The Great Near. I’ll be re-launching “TGN 2.0.” in 2022 with a refresh and a bit more regularity. In the meantime, here’s a weekly curation (read: no more long-form posts for a bit) of content that might push your thinking about power and the systems that shape our lives. I’m talking about the economy, public policy, finance, capitalism, the social sector, and more. Follow for new research, op-eds, hot takes, my favorite explainers, the best learning resources, and fun nuggets so that our heads don’t explode.

—

The Great Near (& Far) 👀 ✨

On reviving rural communities — NPR covered Higher Purpose Co. this week, 💪 an economic justice nonprofit founded and championed by Tim Lampkin. Clarksdale, Mississippi is over 80% African American, yet the majority of businesses are still white-owned. Higher Purpose seeks to change this by helping Black entrepreneurs access the resources they need, whether that’s seed money, grants, or storefront space. Their mentorship program started in 2019 is now serving 300 entrepreneurs. That’s impressive on any day, but consider that was during a pandemic? Higher Purpose also just bought a building in downtown Clarksdale to transform into a new community space, and they’re currently raising capital to launch this hub. Lampkin explains why this work is so necessary:

"If we're going to make special exceptions for entrepreneurs because, you know, they're a white farmer and we know their family, why can't a Black entrepreneur get the same level of access and understanding and patience when it comes to getting access to capital?"

On homeownership and wealth creation — Another winning data tool from Urban Institute. This data viz is gold for policymakers, local housing advocates, or anyone curious about their neighborhoods. I searched for Baltimore, the last/best city I lived in. Here’s a glimpse of the findings. (I could go on and on about the design and functionality of Urban’s tools, but you’re better off seeing for yourself.)

On cherry-picking narratives about the economy — My colleagues have argued that reports about record-high savings rates caused by the pandemic (remember the YOLO economy?) would be more revealing if they were disaggregated by demographics or income bracket. I couldn’t agree more. In that first link from the Wall Street Journal, there is no mention that 19 percent of American households lost all savings during the pandemic, including more than a quarter of Latino and Native American families. For Black families, it’s a shocking 31 percent. That’s according to data put out in late October by NPR, the Robert Wood Johnson Foundation, and the Harvard T.H. Chan School of Public Health. To quote my colleague Eric Horvath (who I credit for many articles that make it into this newsletter), “we need to fight the racial wealth gap like we fight climate change.”

On the ethics of inheritance — This NYT column answers questions from readers about the ethics of inheritance. It’s justifiably surface-level, so here’s adding to the list of resources for anyone grappling with this dilemma: Resource Generation is a community of young people with economic privilege seeking to redistribute their resources, and Chordata Capital is a wealth management firm helping individuals divest from Wall Street and move capital into community-controlled investments. For a simpler approach, investors might look into Calvert’s Community Investment Notes or CNote’s offerings that enable investment in CDFIs/community development organizations. Or, here’s a thought, just give it away.

On reparations — My friend Trevor Smith at Reparations Daily (👈 subscribe) shared a piece from USA Today’s Editorial Board that offers policies for reparations in various sectors like housing or education, and entrepreneurship.

On the “why billionaires shouldn’t exist” thing — This article in Insider exposes Mark Zuckerburg’s newest PR crisis: purchasing 1,382 acres of kuleana land in Hawaii, originally created to preserve land for Native Hawaiians. It’s paywalled, so here are the deets. Using shell companies that quietly forced owners to sell, Zuckerburg acquired this sprawling property despite local backlash. Much of it came from heirs of plantation owners involved in the overthrow of the Hawaiian Kingdom. This comes at a time where nearly half of Native Hawaiians have left the islands as the median home price soars above $1 million. Tech millionaires/billionaires now own 60% of private land on Kauaʻi, where the estate is located. The facts speak for themselves, though this quote from Randy Naukana Rego, a Kanaka Maoli whose family once owned pieces of Zuckerburg’s land, drives the point home:

“Americans put down monarchies, yet they’ve created kings themselves and they’re called billionaires. They may not call them kings or monarchs, but they have total control over the land.”

America’s founding was fueled by land stolen from Indigenous people. As policymakers attempt, often poorly, to atone for that history, let’s hope that they don’t turn a blind eye to the reckless, tyrannical billionaires following in those footsteps. I’m curious about land trust initiatives/community wealth-building groups in Hawaii if any readers can drop that in the comments.

And lest we forget…

Some good news — A new company, Known Holdings, is building what it calls a “mother ship” for Black, Indigenous, and Latino leaders on Wall Street. The goal is to help entrepreneurs launch and fuel firms and funds that will be strong enough to dominate for decades. Molina Niño, a co-founder, calls it “owning the machinery that runs the economy.” 👏👏👏

On gentrification — Darrell Owens, a housing and transit activist offers a more nuanced look at gentrification in The Discourse Lounge, drawing from experience watching his neighborhood change in Berkeley, California. This quote stuck with me: “Gentrification in my experience was an internal crisis, not an external or aesthetic one.” He argues that the debate is too often reduced to a binary between disinvestment and gentrification; that any sign of “newness” has become cause for alarm when there is little evidence that bike lanes or traffic safety improvement, for example, are warning signs of impending shifts. He digs into what underlies this.

On CDFIs — Community development financial institutions, CDFIs, are financial institutions committed to providing affordable lending in disadvantaged communities. If you’ve never heard of them, that’s okay! They don’t get the attention they deserve. This recent op-ed by Carolina Martinez argues that next year, Congress should match the $1.25 billion commitment made to CDFIs last June given the success of lending programs in lending to underserved entrepreneurs through the pandemic.

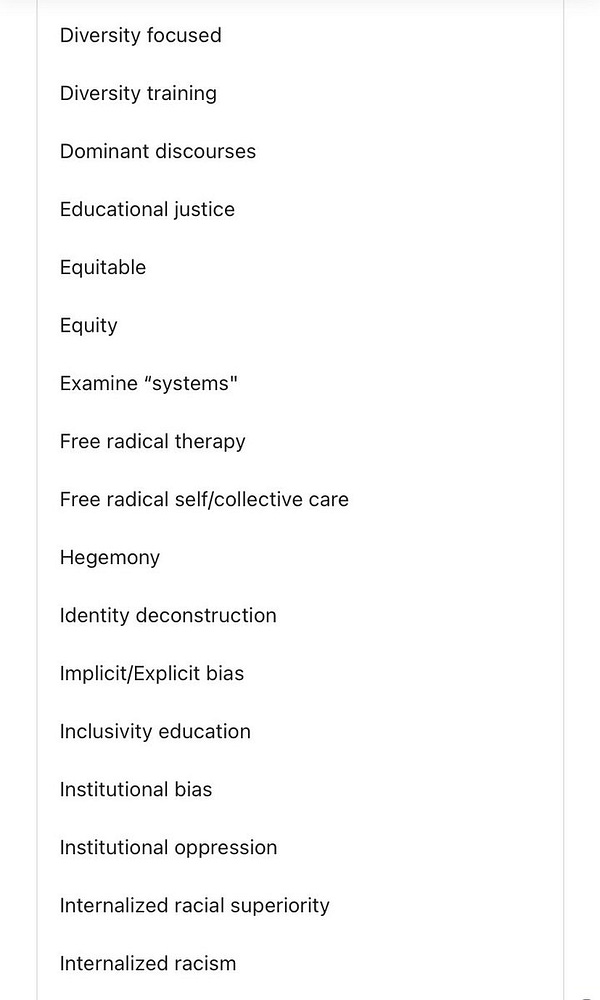

(More) on critical race theory — As many have pointed out on Twitter, this is George Orwell’s Newspeak come to life in full technicolor: a fictional system from Nineteen Eighty-Four, that restricted language to prevent people from thinking about subversive concepts. Look, there should be debate about what we teach kids—this conversation with a Black parent in Evanston, Illinois is a good example—but it’s a sad day in America when elected officials resort to banning the concepts that help young people make sense of a complex world. This list includes terms like “examining systems,” and “critical self-awareness.” Another Twitter user commented that many of these concepts speak to the lived experience of many students of color, like “racial prejudice.” We’re putting the next generation and the future of the country on the line by normalizing these attacks.

Today’s roundup was… bleak. Here are a few Tiktoks to remember that there’s good in the world: a happy minipig, a fox stealing a phone, and a herd of deer eating breakfast.

p.s. next week will be the final TGN post of the year! 😱

until next time,

Caitlin